18 Which of the Following Best Describes Term Life Insurance

With a joint life insurance policy which of the following best describes the coverage continuation option available to the surviving insured upon the death of the first insured. B The shorter the premium period the slower the cash value will grow.

What Best Describes A Scrum Team

During this time the policy face amount was increased to 150000.

. An insured has a variable life policy with a 100000 face amount. The insured is covered during his or her entire lifetimeB. Which of the following best describes term life insurance.

The insured is covered during his or her entire lifetime. A term life insurance policy is the simplest purest form of life insurance. It should be noted that coverage is also for a specified number of years.

You pay a premium for a period of time typically between 10 and 30 years and if you die during that time a cash benefit is paid to your family or anyone else you name as your beneficiary. At one time the cash value exceeded 100000 and was worth 150000. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

The insured pays a premium for a specified number of years. The insured is covered during his or her entire lifetime. B A 10-year renewable term is a policy in which the premium and face amount increase at the end of each 10-year period.

Added 4142012 54814 PM. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. The insured pays a premium for a specified number of years.

Which of the following best describes term life insurance. C Whole life insurance is designed to mature at age 100. The insured pays a premium for a specified number of years.

An insured borrows money from the bank and makes a collateral assignment of a part of the dead benefit to secure the loan. The insured can borrow or collect the cash value of the policy. Log in for more information.

In the following year the cash value took a significant decline and was worth only 70000. The insured pays the premium until his or her deathC. All of the following best describes Term Life Insurance EXCEPT.

The insured pays the premium until his or her death. The insured can borrow or collect the cash value of the policy. Which of the following best describes term life insurance.

The insured pays a premium for a specified number of years. Benefits are doubled under certain circumstances stated in the policy b. All of the following examples of third-party ownership of a life insurance policy EXCEPT.

An insured couple purchases a life insurance policy insuring the life of their grandson. The insured pays the premium until his or her death. The insured pays the premium until his or her death.

A A 10-year renewable term is a policy with a level premium and a corresponding decreasing face amount. 72 of Americans answered this question correctly. Term insurance builds cash value.

Plans typically range from five to 30 years and issued in five-year increments although yearly renewable term plans expire at the end of. Is a tool to reduce your risks. Which of the following best describes term life insurance.

The insured is covered during his or her entire lifetime. The choice that best describes term life insurance is. Which of the following best describes term life insurance.

Which of the following BEST describes a double indemnity provision in travel accident insurance. A The face amount of the policy gradually increases the longer the policy remains in force. The insured pays a.

Common terms for term life are 10 15 20 or. The insured is covered during his or her entire lifetime. Which of the following best describes term life insuranceA.

Written for a specified time period. The insured can borrow or collect the cash value of the policy. The insured pays a premium for a specified number of years.

Term life insurance expires at the end of the contracted term which is determined when you purchase the policy. Term insurance only pays if the insured dies or becomes disabled. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Term insurance could be for 5 10 or 20 years. The insured pays the premium until his or her death.

Which of the following best describes term life insurance. The surviving insured may buy an individual policy with the same or a lesser face amount without having to provide evidence of insurability. Life term insurance is temporary life insurance that lasts for a specific period of time.

Which of the following best describes term life insurance is a tool to reduce your risks. The insured pays a premium for a specified number of years. The insured can borrow or collect the cash value of the policy.

The insured is covered during his or her entire lifetime. Suppose that under your health insurance policy hospital expenses are subject to a 1000 deductible and. The insured can borrow or collect the cash value of the policy.

Which of the following statements describing whole life insurance is CORRECT. Starting a family getting married starting a business or switching to a profession where danger is involved are all great reasons to take out a policy. Of the following which statement best describes a 10-year renewable term life insurance policy.

Term insurance premiums are based largely on the age of the insured. Which of the following best describes term life insurance. The insured pays the premium until his or her death.

The insured is covered during his or her. Term life insurance covers you during the most important years of your life The best time to open a term life insurance policy is when youre expecting to make a big life decision. If the claim is disputed in court and the insurer loses the face amount will.

Term life insurance may last from 1-30 years.

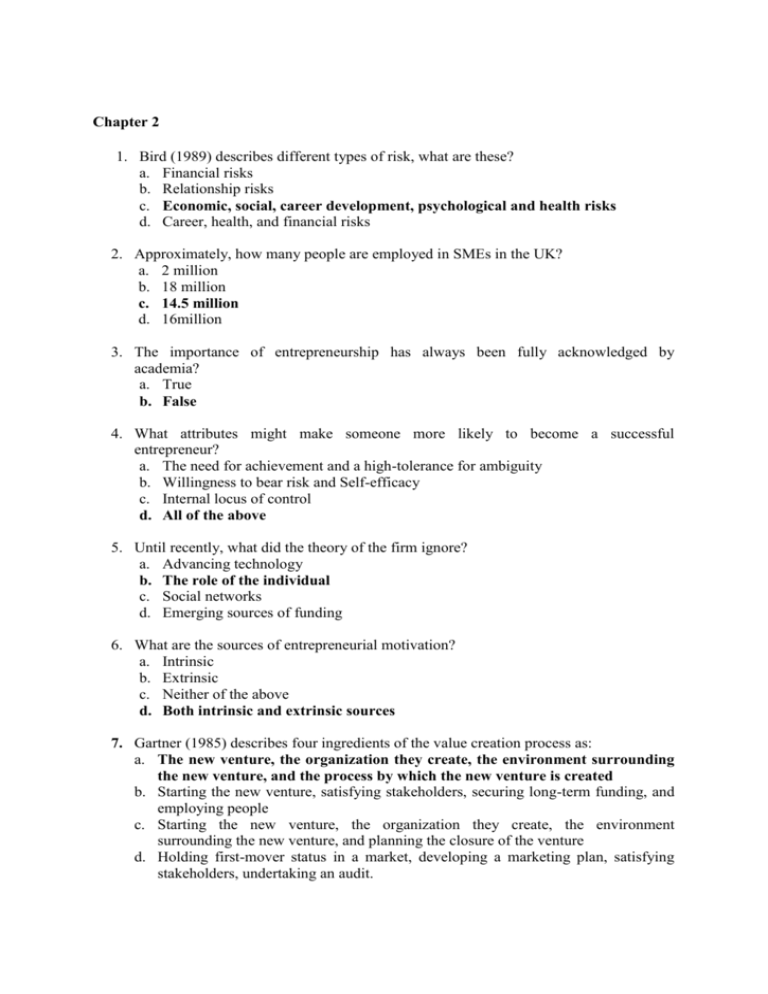

Ap Bio Unit 3 Flashcards Practice Test Quizlet

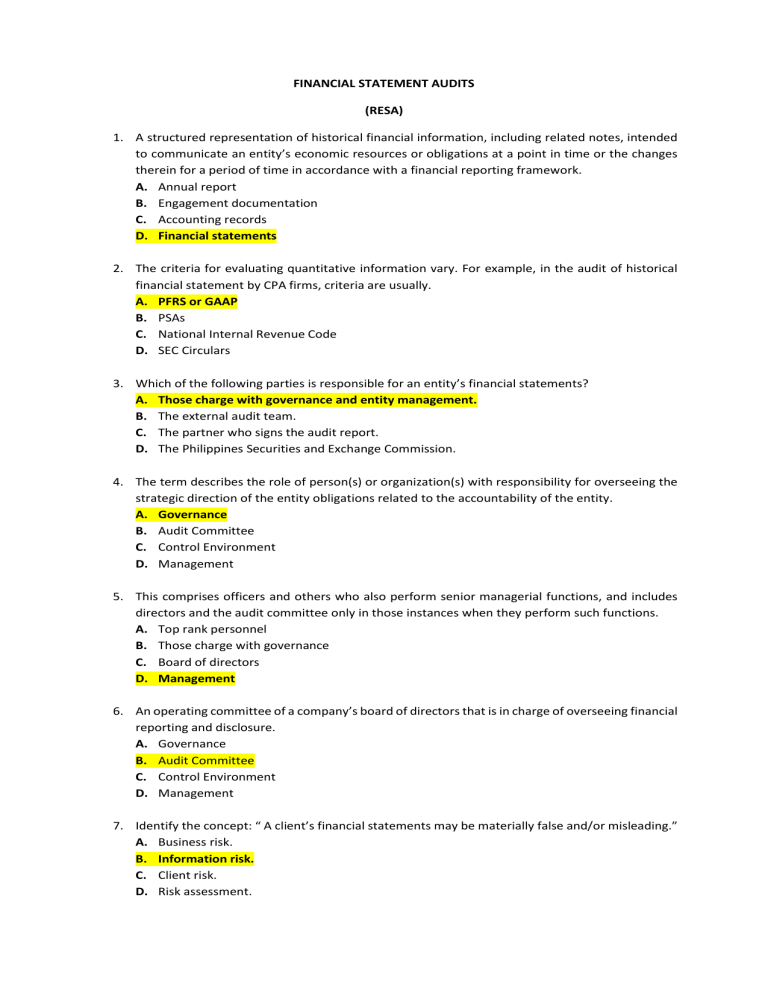

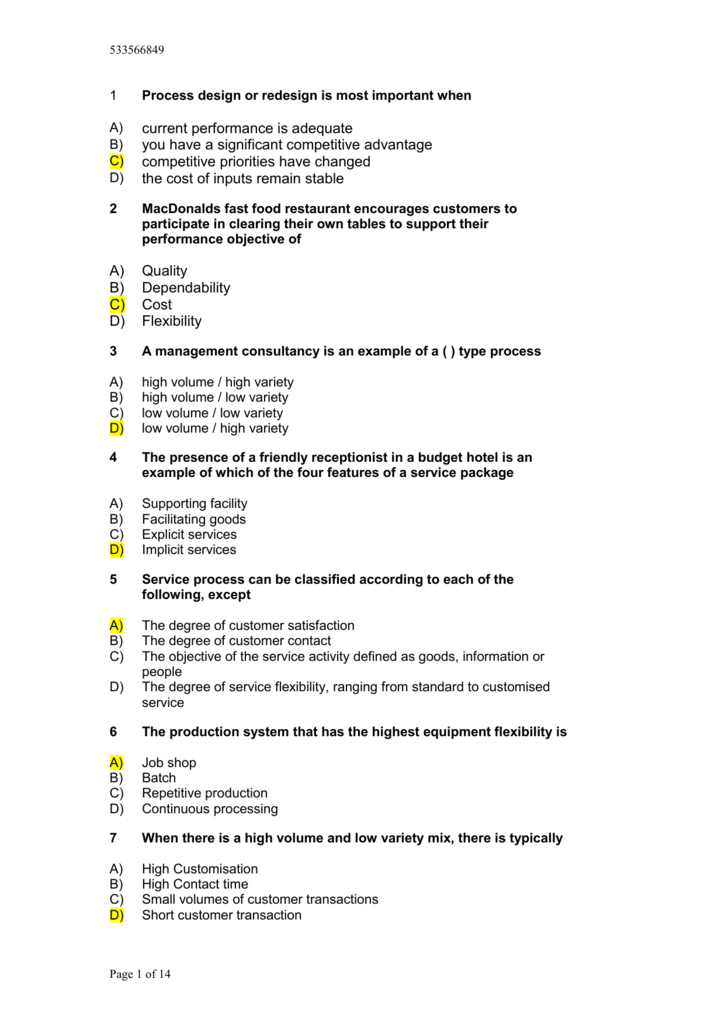

Answers To Multi Choice Session 2 Product Process Layout Design

Pin On Irritable Bowel Syndrome Ibs

Download Pdf Money Wealth Life Insurance How The Wealthy Use Life Insurance As A Taxfree Pe Life Insurance Quotes Term Life Insurance Quotes Insurance Quotes

Caloriesfd On Instagram Metabolism Is A Term That Describes All The Chemical Reactions In Your Body These C Diet Exercise Activities Steady State Cardio

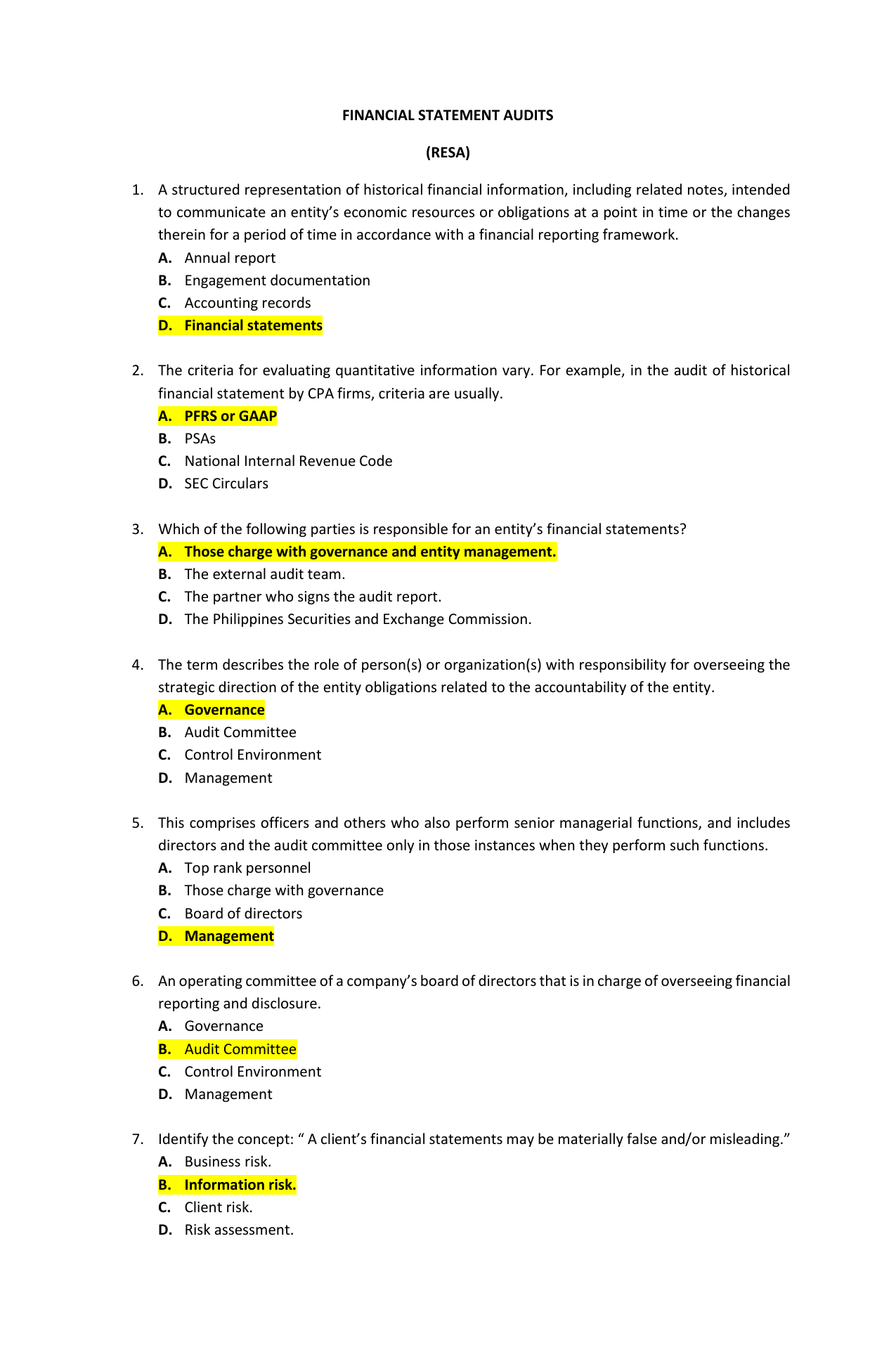

Exam 2 Review Homework Flashcards Quizlet

9 Incredible Intermittent Fasting Results Women Fitness Magazine Intermittent Fasting Results Intermittent Fasting Rules Intermittent Fasting

What Best Describes A Scrum Team

We Offer Individual Health Insurance Family Floater Health Cover Extended Health Insurance A Health Insurance Plans Individual Health Insurance Insurance Ads

Ecology Vocabulary Matching Sort W 46 Terms Definitions Real World Examples Vocabulary Social Studies Worksheets Vocabulary Activities

Apple Might Launch The Airpods 3 Apple Music Hi Fi Tier On May 18 Apple Music Hifi Music

Lifeskills Cards For Teens Which Best Describes You Describe Yourself Self Awareness Life Philosophy

Company Monthly Budget Template Budget Template Uk Making Own Budget Template Uk To Make A Clear Monthly Budget Template Budget Template College Budgeting